Seed Stage Funding Crunch Coming?

Innosphere Ventures works at the Intersection of Technology Startups, Venture Capital, and Technology-Based Economic Development in the U.S. Mountain & Plains Region

Author: Mike Freeman, Innosphere Ventures General Partner and CEO

PitchBook recently published its report on “2020 Private Funds Strategies,” and I found interesting data in this report to digest. In my analysis of the data, I want to focus on Venture Capital trends as well as touch on the strategies around PE, real estate, and private debt.

A few trends to think about:

Global Venture Capital (VC) saw an increase in capital raised in 2020 to $111.6B — a 20.4% increase. This increase is a good indication that Limited Partners are continuing to back Venture Capital as an asset class. While this is good news, there are additional trends we need to understand that point to a crunch in seed-stage capital. On a year-over-year basis, 602 funds were closed (globally), representing a -27% decrease. Let’s dig into this trend a bit more (as my bias in this blog is to better understand early-stage VC).

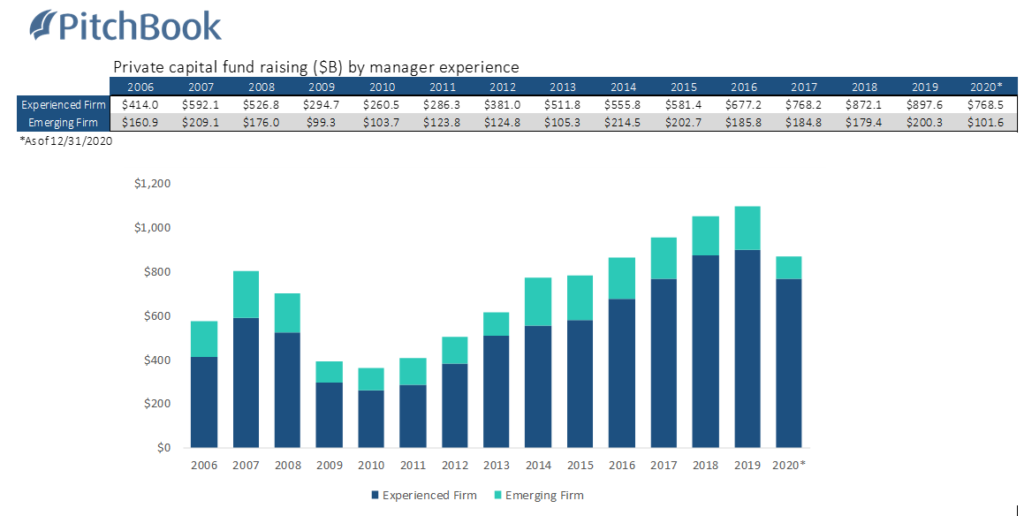

PitchBook reports that Limited Partners (investors) primarily backed established funds/managers (defined as 4+ venture funds, versus emerging managers who have managed less than 4 funds). Over time, this translates to an estimated 78% of all invested capital going to experienced funds/managers, as the following data illustrates:

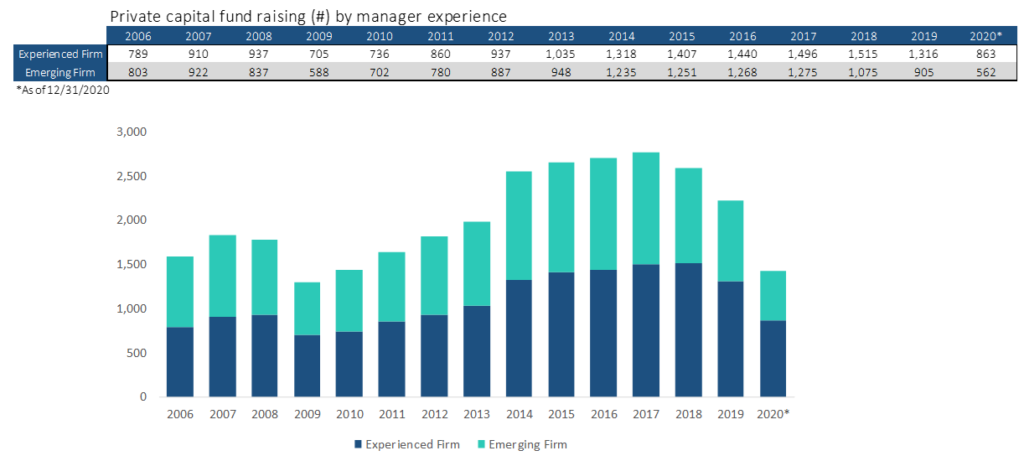

When we look at the number of funds backed by both experienced mangers and emerging managers, the raw number of closed funds between the differing VC manager types is not as dramatic, as seen in the following table/data. It is interesting to note the overall drop-off in funds run by both experienced managers and emerging managers in 2020.

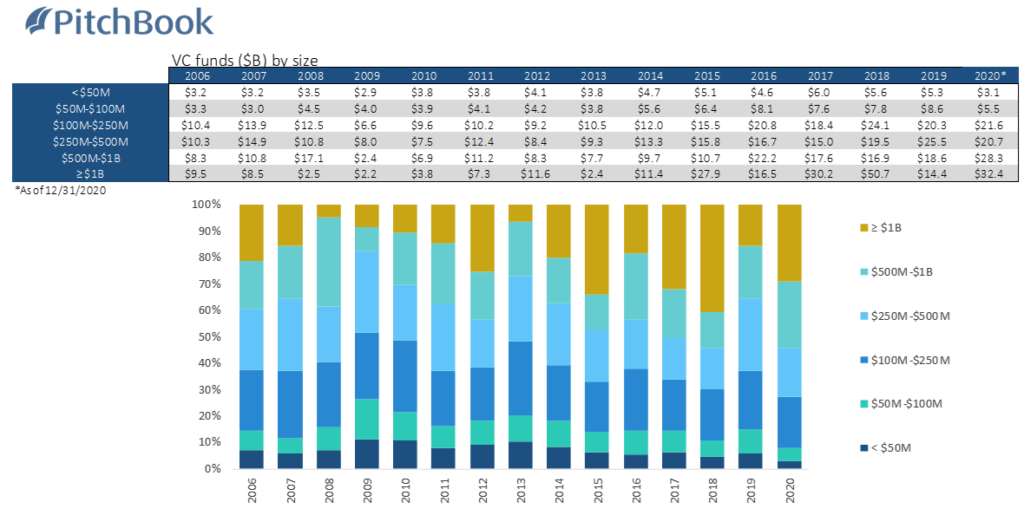

The data is pretty clear that Limited Partners are backing larger funds, making fund sizes increase.

“In 2019, 18.2% of capital went to emerging managers, but their share hit a 15 year low of 11.7% in 2020.” – PitchBook Data

“These trends in fund count and value imply a significant growth in average and median fund sizes, which the data reflects.” – PitchBook Data

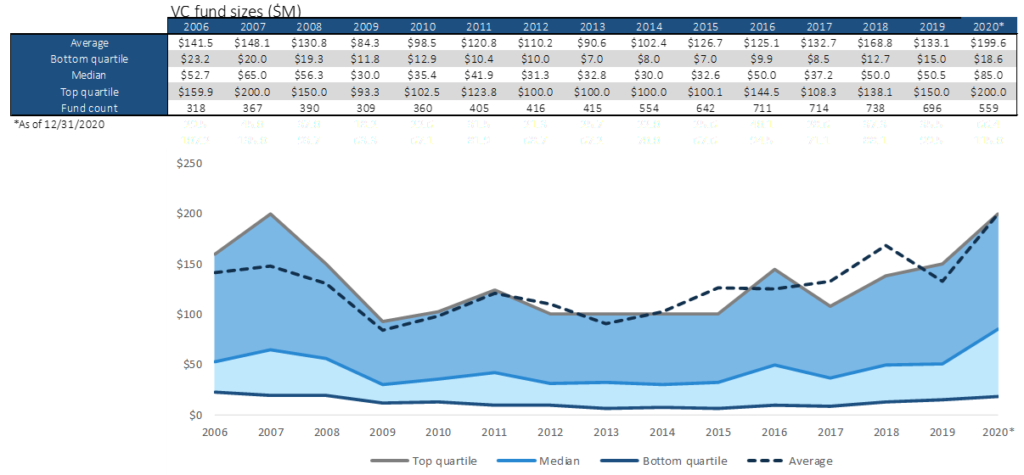

In 2020, the median fund size jumped (in just one year) from $50M to $85M. I’ll try to put this fact in perspective for early-stage founders of technology companies:

- Data indicates that micro-venture capital funds (below $50M) are prolific investors in seed-stage companies. There are simply fewer micro-VCs coming online.

- Average fund size is rapidly increasing – putting pressure on larger funds’ ability to participate in seed rounds of funding (my definition ~$1.5M). Why? The lead investor may take 50% to 75% of a seed round, and this amount of capital is too low for larger funds. The result is that larger funds will seek either larger seed rounds or A-round participation.

- Valuation at the seed stage is going to be further compressed. There are just fewer seed-stage investors and fewer who will lead an investment round at the seed stage. It’s simply a supply and demand issue. There is evidence that this appears to be a trend, as angel and seed-stage valuations decreased in 2020 while later-stage valuations increased (more competition, more funds).

This trend may help high-net-worth individuals, family offices, and foundations with lower assets under management (AUM) to support new seed-stage venture funds in their region. Here at Innosphere we know that early-stage funding is critical to moving technologies forward and beginning the early scaling process.

Blog author: Mike Freeman, General Partner and CEO of Innosphere Ventures

About Innosphere Ventures

Innosphere Ventures is a Colorado-based incubator that accelerates business success of science and technology-based startups and emerging growth companies with an exclusive commercialization program, specialized office and laboratory facilities, and a seed-stage venture capital fund. Innosphere has been supporting startups for over 22 years and is a non-profit 501(c)(3) organization with a strong mission to create jobs and grow the region’s entrepreneurial ecosystem.

Apply Now: Innosphere Ventures is accepting applications from science & technology startups to join the Commercialization and Incubation Program

Let us help you accelerate the success of your company with our commercialization and incubation programs that focus on helping entrepreneurs learn valuable skills on how to be investor-ready, access capital, acquire customers, build talented teams, accelerate top line revenue growth, and (if it’s your goal) execute a successful exit of your company.

We’d love to learn more about your company or technology. Please submit an online application this month at https://innosphereventures.org/.